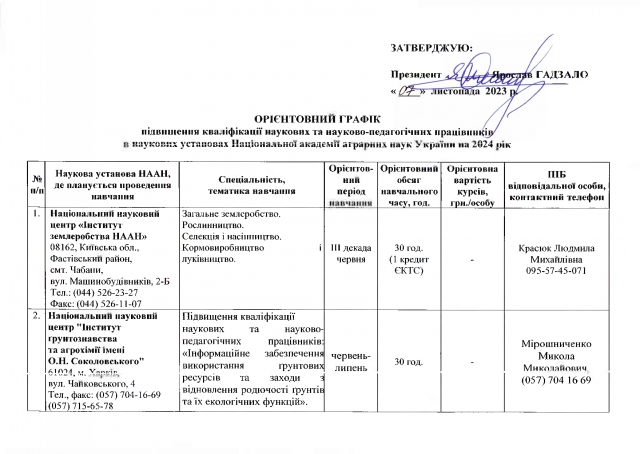

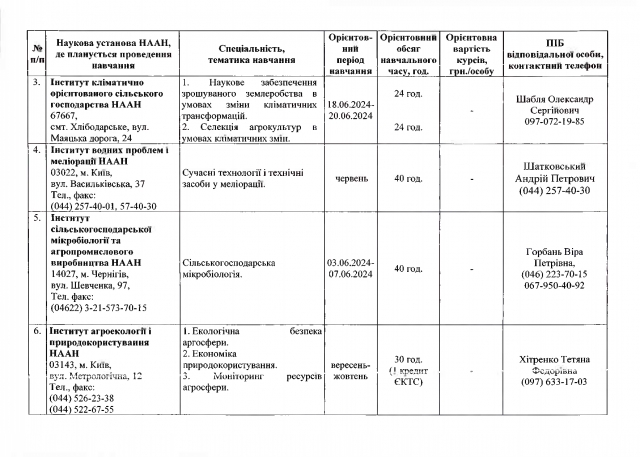

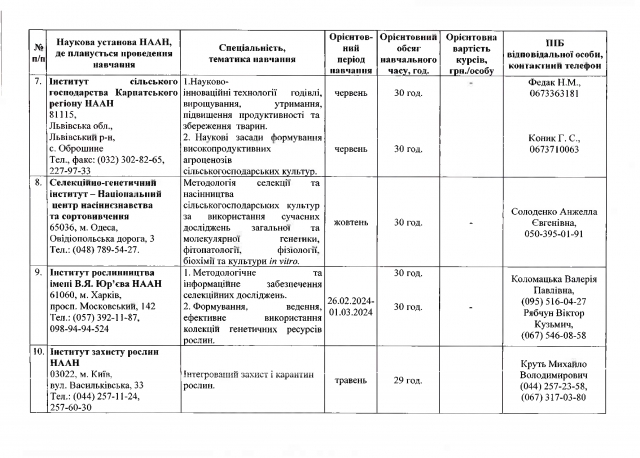

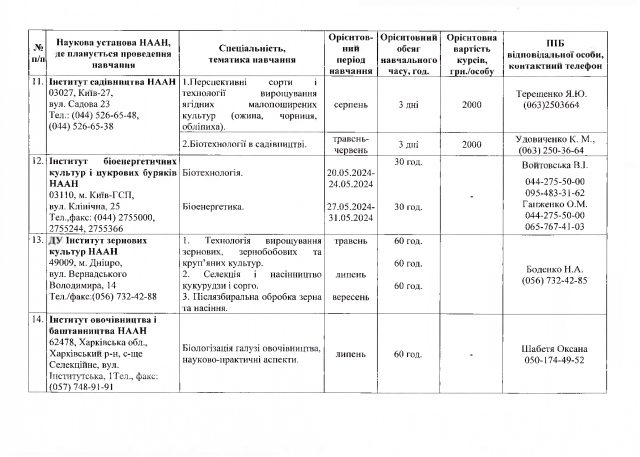

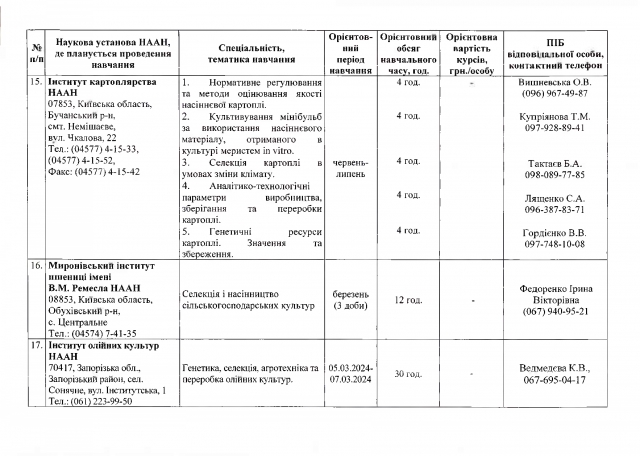

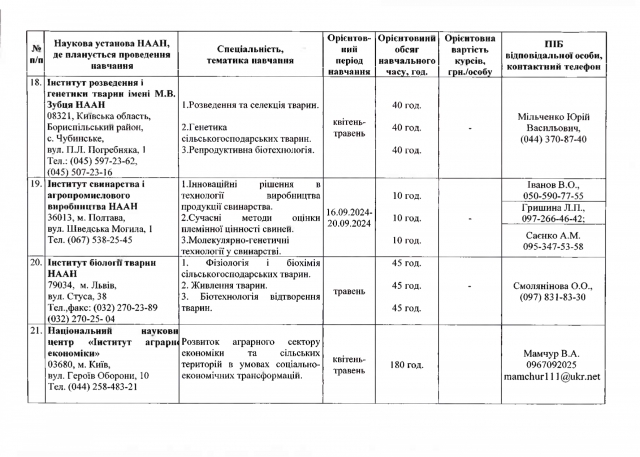

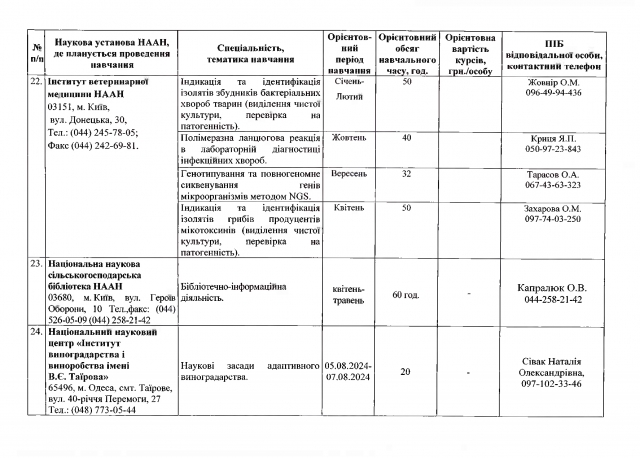

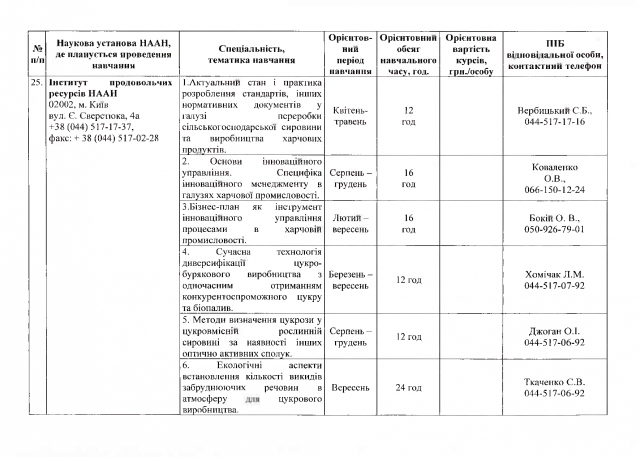

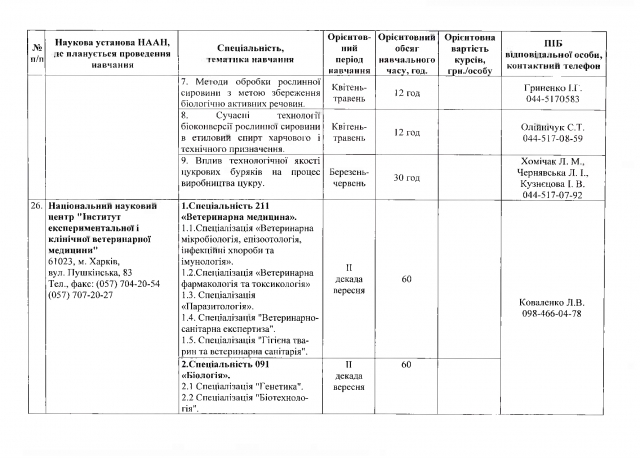

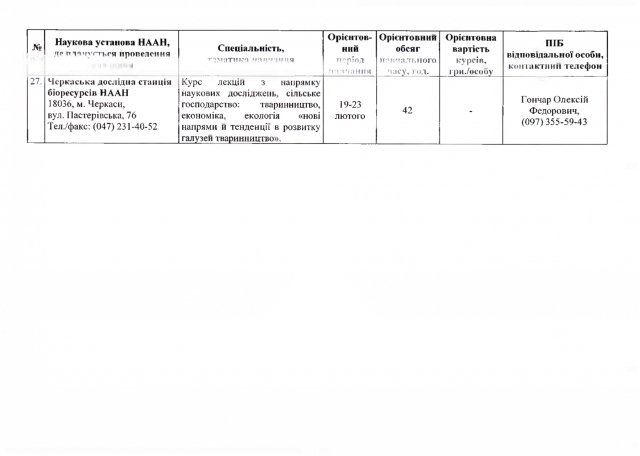

УВАГА!!! Орієнтовний графік підвищення кваліфікації наукових та науково-педагогічних працівників в наукових установах Національної академії аграрних наук України на 2024 рік

Детальніше за посиланням: sites/default/files/u402/spisok_pidvishchen.pdf

Реєстрації на курси підвищення кваліфікації відбувається централізовано від факультету офіційним листом.

Для реєстрації на будь-який із зазначених курсів необхідно надіслати електронний лист з наступною інформацією:

- Тема: Хочу зареєструватися на курси підвищення кваліфікації;

- E-mail: [email protected];

- назва інституту, що проводить підвищення кваліфікації;

- тематика курсів підвищення кваліфікації (вказана в графіку);

- ПІП учасника курсів;

- факультет, кафедра;

- електронна адреса;

- номер телефону.